The Florida Real-Estate Market and the Minimum Wage Increase

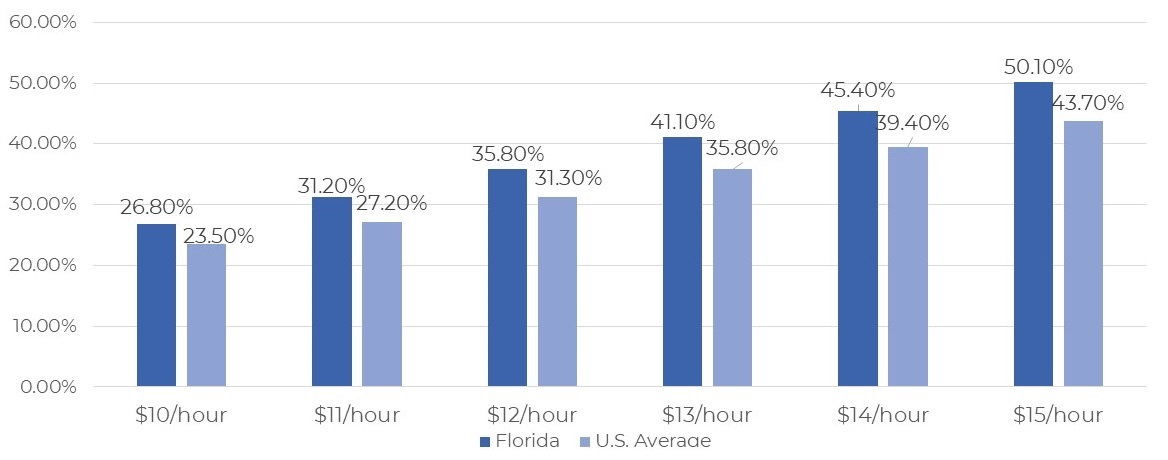

Minimum wage increases are a constant yet controversial subject across America, with politicians, economists, activists, and the general public weighing the pros and cons. Broadly speaking, the effects of any increase tend to be viewed as positive for low-wage earners and negative for small businesses. The national debate surrounding the $15 minimum wage rages on, but Florida voters passed a ballot proposition last November that will raise the statewide minimum wage to $15 an hour. Florida is the 8th state to pass such a resolution. According to the Economic Policy Institute, this measure will raise wages for around half of Florida’s workforce (as 50.1% of people currently earn less than $15 an hour).

Concentrarions of Low-Wage Workers – Florida VS. Nationwide

Statewide, 3.85M workers (50.1%) earn under $15 an hour; 2M (26.8%) earn under $10 am hour

When and How?

Florida’s minimum wage will gradually be raised to $15 an hour over the next six years.

Currently set at $8.56, the minimum raise will increase to $10 per hour in September 2021, and will then increase by $1 every year until it reaches $15 an hour in 2026.

Then, from September 30, 2027, Florida’s minimum wage will be adjusted for inflation on an annual basis.

Effects of Raising the Minimum Wage

Economists have always differed in terms of both the type and extent of economic consequences that may arise as a result of minimum wage increases – and they continue to represent a whole spectrum of views today. Main points on each side include possible effects on jobs, inflation, small businesses, and the federal deficit.

The standard reasoning against raising the minimum wage is that wage increases are an inefficient way to ward off financial insecurity. However, if the increase is too high and places too great a burden on businesses, it can also affect employment.

Advocates for raising the minimum wage argue that a higher starting wage will increase financial stability for low-wage earners, giving them more money for expenses and necessities like rent, and reduce government welfare spending. As low-wage workers tend to spend most of their extra earnings, this will help to stimulate the economy and spur increased business activity and job growth. In addition, there will be less job mobility, and workers will keep their jobs longer, which will offset the cost of higher wages. Increasing the minimum wage also benefits large companies and urban areas, which can support higher wages than small businesses and rural areas.

Crucially, from our perspective, raising the minimum wage strengthens investors’ ability to raise rent accordingly in lower-income areas. It also significantly reduces the risk of missed rent.

U.S. Job Openings Hit Record High as Wokers Quit in Droves

Hiring Diffculties & Worker Attitudes

The U.S. Economy Currently has More Open Jobs than Job seekers

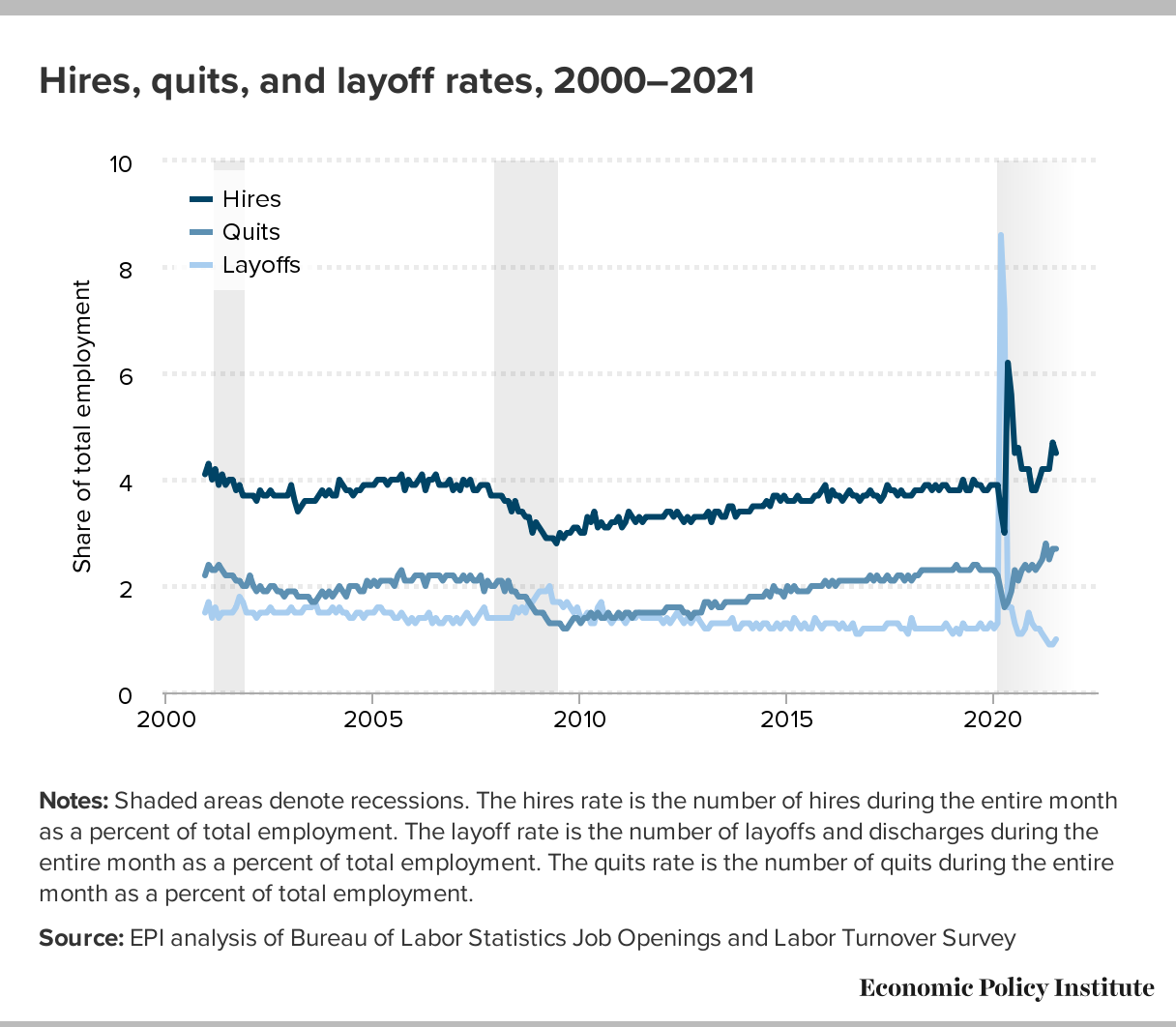

Experts attribute current hiring difficulties to several primary factors: unemployment benefits, pandemic concerns, and childcare. One thing is clear, the issue is not down to a shortage of jobs. In June, according to the Job Openings and Labor Turnover Survey, U.S. job openings soared to a record 10.1 million, exceeding available workers for the first time since the pandemic recession began. A handful of sectors were even tighter than the broad ratio implied. The wholesale trade sector — businesses that sell goods and merchandise to retailers — had a three-month average ratio of just 0.4 workers-per-opening, per Economic Policy Institute data. That made it the tightest industry in the U.S. Meanwhile, the finance, insurance, and government sectors displayed similar ratios of 0.6, and restaurants and accommodation businesses had ratios of 0.8.

The sectors most adversely affected by the COVID-related economic shutdown are still struggling to fully recover. Pandemic-related concerns are still a key factor for many Americans, as jobs that require physical interaction with other people (nurses, servers, checkout staff, hotel cleaners, etc.) continue to receive substantially fewer candidates than open positions. University of Massachusetts Boston professor Françoise Carré noted that retail jobs have been particularly grueling during the pandemic because of their “frantic pace” and employees’ fears over catching COVID-19.

Harvard University economist Lawrence Katz has highlighted the fact that, while many employers might want things to go back to the way they were before the pandemic, many workers have something else in mind. “It’s a mismatch of expectations and aspirations,” he said.

Rich Templin, a lobbyist for Florida AFL-CIO, a federation of labor unions around the state, commented that the biggest issue is that jobs in the tourism and service industries don’t pay well and don’t provide benefits. “We are seeing a major reset of the labor market in this country because of what we just went through and what we’re going through right now. What business owners are saying is, ‘We want you to come back under the old rules and be paid poverty-level wages,’” Templin said. “And people are saying, ‘no.’”

Chris Tilly, a professor at UCLA’s Luskin School of Public Affairs, said it’s hard to make predictions about what’s next for the labor market, but noted that consumer demand appears to be outpacing retailers’ ability to staff stores – circumstances that give workers more leverage. “I don’t think we’re at a point where workers have permanently gained the upper hand, but I would be cautious about saying exactly when the power is going to shift back more to employers,” he said. The central issue is that “retailers are having trouble attracting workers at the rates of pay that they’re offering. Consumer demand is expanding faster than people are able and willing to go back into the labor force,” he said.

Echoing his sentiments, Sylvia Allegretto, a UC Berkeley labor economist, pointed out: “There’s simply no labor shortage when you’re talking about finding house cleaners for a hotel—there is a shortage of workers who want to work at what you’re offering.” She said the country is experiencing a “wage and benefits shortage.”

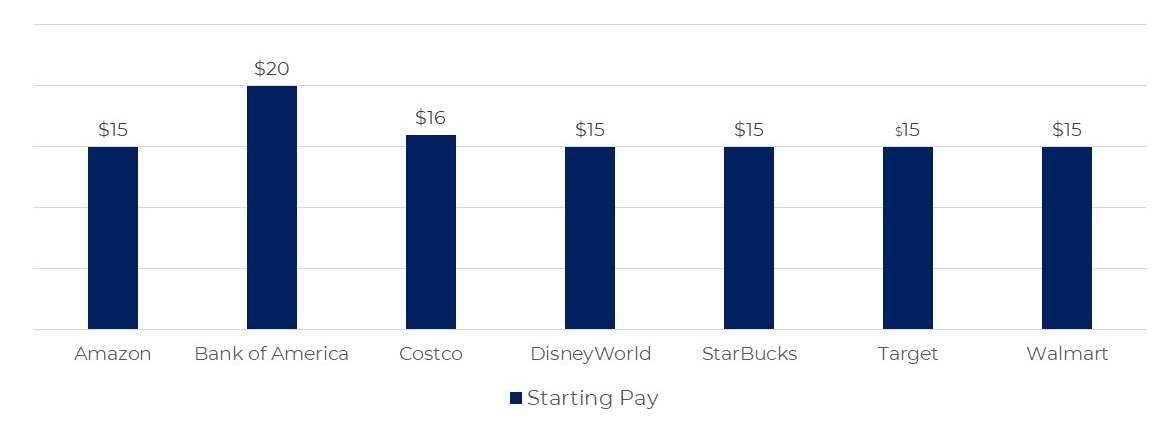

Leading Brands are Raising Wages

The availability of vaccines, paired with a broader reopening of the economy, has spurred a snapback in economic activity in recent months, and consumer demand has vastly outpaced businesses’ hiring ability. Scrambling to find workers as business surges, many companies have started to raise wages and offer hiring bonuses to attract candidates. Average hourly earnings were up 4% last month over the same period last year. In May, Chipotle announced plans to raise its hourly wages to an average of $15 by the end of June. Soon after, McDonald’s said it would raise the hourly wage of its restaurant employees by an average of 10%. Costco is among other companies that recently pledged to increase their minimum wages to at least $15. Disney is also offering $1,000 bonuses to recruits who sign up to become housekeepers and kitchen staff amid the labor shortage.

“If a bunch of large employers in the labor market raise pay, other employers are going to be compelled to raise pay a little bit too, to make sure that they can recruit and retain their workforce,” Ben Zipperer, an economist at the left-leaning Economic Policy Institute, told Insider in March. Zipperer said that small businesses in those areas will probably feel those spillover effects and will likely feel compelled to respond.

A recent working paper from the University of California examined the impact of Amazon, Whole Foods, Target, Walmart, and Costco’s starting wage increases. The researchers found that minimum wage raises at big firms may have had a knock-on effect at other businesses in the area. Following wage increase announcements at large companies, nearby firms followed suit, even matching the announced wage in some cases.

MANY INDUSTRY LEADERS SUCH AS AMAZON, WALMART, DISNEY, AND MORE HAVE ALREADY MADE THEIR STARTING WAGE AT +$15 AN HOUR.

The study looked at the companies that were most affected by these increases or employers in the same labor market where a large share of wages before the announcements was at rates below the new voluntary wages of these major companies. According to the research brief, the more affected companies went from having similar wages to the less affected companies before the big company announcements, to then raising their advertised wages significantly afterward.

A separate report from the Labor Department’s Bureau of Labor Statistics noted that the big monthly hike in consumer prices translated into negative real wages for workers in the month of June. Real average hourly earnings fell 0.5% for the month, as the CPI increase negated a 0.3% increase in average hourly earnings.

Florida Postioned as Long Term Winner Post COVID

As a direct result of Florida’s generally well-balanced approach to handling the pandemic, protecting the state economy alongside public health, the Sunshine State has become a leader in population growth. More Americans are now choosing to move to Florida than ever before.

Florida’s unemployment rate now stands at 5%, lower than the 5.4% national unemployment rate. In addition, the state’s attractive tax policies (including 0% state income taxes) are a strong allure for both businesses and high-earners.

It is against this backdrop that Florida has become the first southern state to raise the minimum wage to $15 by 2026. More than 50% of the Florida workforce will receive a pay raise (as they now earn less than $15 an hour). This will naturally attract young blue-collar workers from neighboring states to Florida.

As a result of Florida’s proactive yet thoughtful economic planning, creating balanced initiatives to boost the economy, the state may well have hit on a winning strategy that others are sure to follow.